The Two Faces of ROI

ROI lives in two worlds: the forecast and the proof. The best leaders use it to price the future—and verify it over time.

A few weeks ago, I wrote Playing a Winnable Game: Why Cybersecurity Leaders Must Master Strategic Finance — about treating cybersecurity as capital allocation, not cost control. It’s a good primer for what I’m seeing surface again right now.

As we head into budget planning season for the next calendar year, one theme keeps showing up in every conversation: ROI.

Executives love certainty. Boards demand it. Vendors try to simulate it.

And somewhere in that tension lives the great illusion of modern enterprise finance—the illusion of pre-proven ROI.

ROI isn’t an oracle. It’s a model. It doesn’t predict the future; it helps you price it.

And in that sense, it functions much like Net Present Value (NPV) or the time value of money: both are forecasts that rely on real data, reasonable assumptions, and continuous refinement.

When leaders expect “proven ROI” before an engagement begins, what they’re really asking for is a forecast without inputs.

That’s not rigor—it’s wishful thinking dressed as discipline.

ROI as Forecast, Not Faith

ROI forecasting is not a sales tactic; it’s a financial instrument.

In finance, investors don’t demand proof of return before deploying capital. They model expected return using known variables: capital costs, cash flows, discount rates, and risk-adjusted assumptions.

Cybersecurity investments should be treated the same way.

Potential ROI is calculated through financial modeling, not conjecture. The process applies economic principles to project the present value of future benefits relative to the present value of future costs.

The key distinction is that ROI modeling is forecastable, not hypothetical.

It’s a legitimate form of decision analysis that provides directional confidence—not false precision.

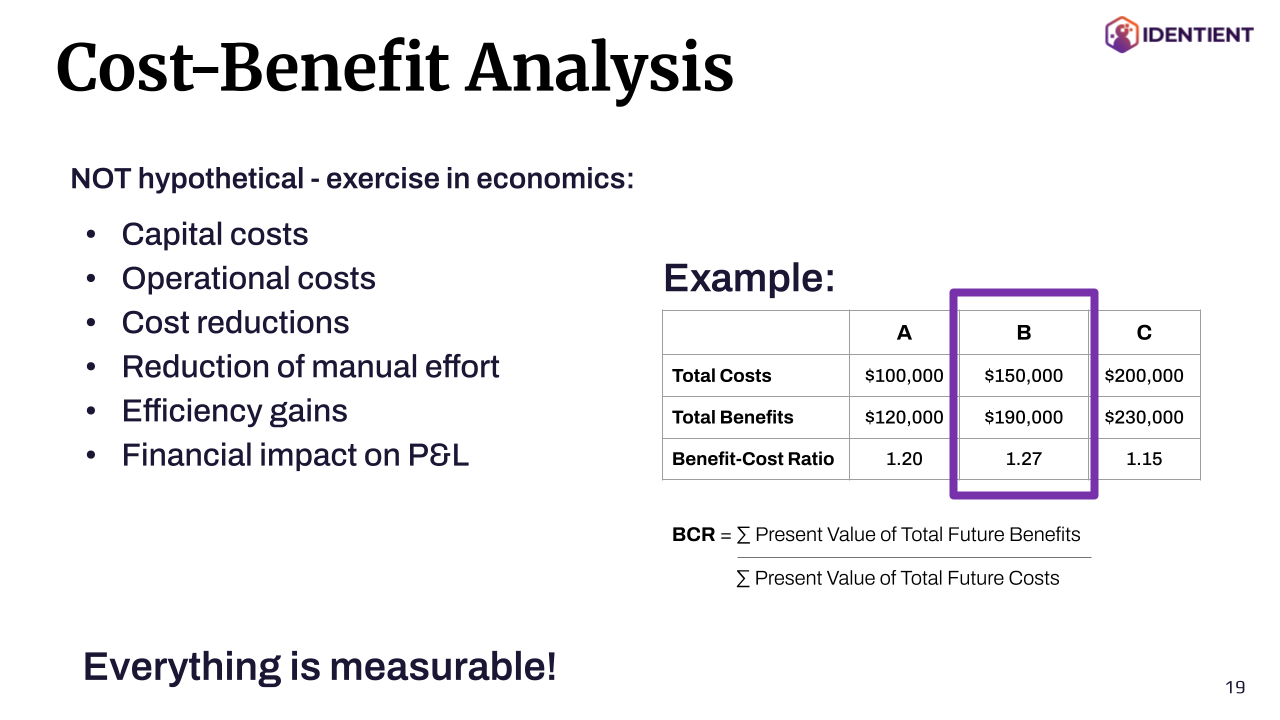

The Discipline of Cost-Benefit Analysis

A well-constructed Cost-Benefit Analysis (CBA) is the backbone of ROI modeling.

It’s not about storytelling—it’s an exercise in economics.

The data required isn’t secret; it’s just often unavailable to external partners. It includes:

Capital costs

Operational costs

Cost reductions

Reduction of manual effort

Efficiency gains

Financial impact on the P&L

Each of these inputs connects directly to real financial systems—your ledger, your labor data, your operational reports. Without those inputs, external ROI projections are like calculating NPV with blank cells.

As shown in the example:

Alternative Total Costs Total Benefits Benefit-Cost Ratio A $100,000 $120,000 1.20 B $150,000 $190,000 1.27 C $200,000 $230,000 1.15

The Benefit-Cost Ratio (BCR) is calculated as:

BCR = Σ Present Value of Total Future Benefits / Σ Present Value of Total Future Costs

A ratio above 1.0 means benefits outweigh costs; the higher the number, the greater the return on investment.

But the value of the analysis isn’t in the number—it’s in the inputs.

Everything in cost-benefit analysis is measurable, but nothing is meaningful until the data reflects the realities of your environment.

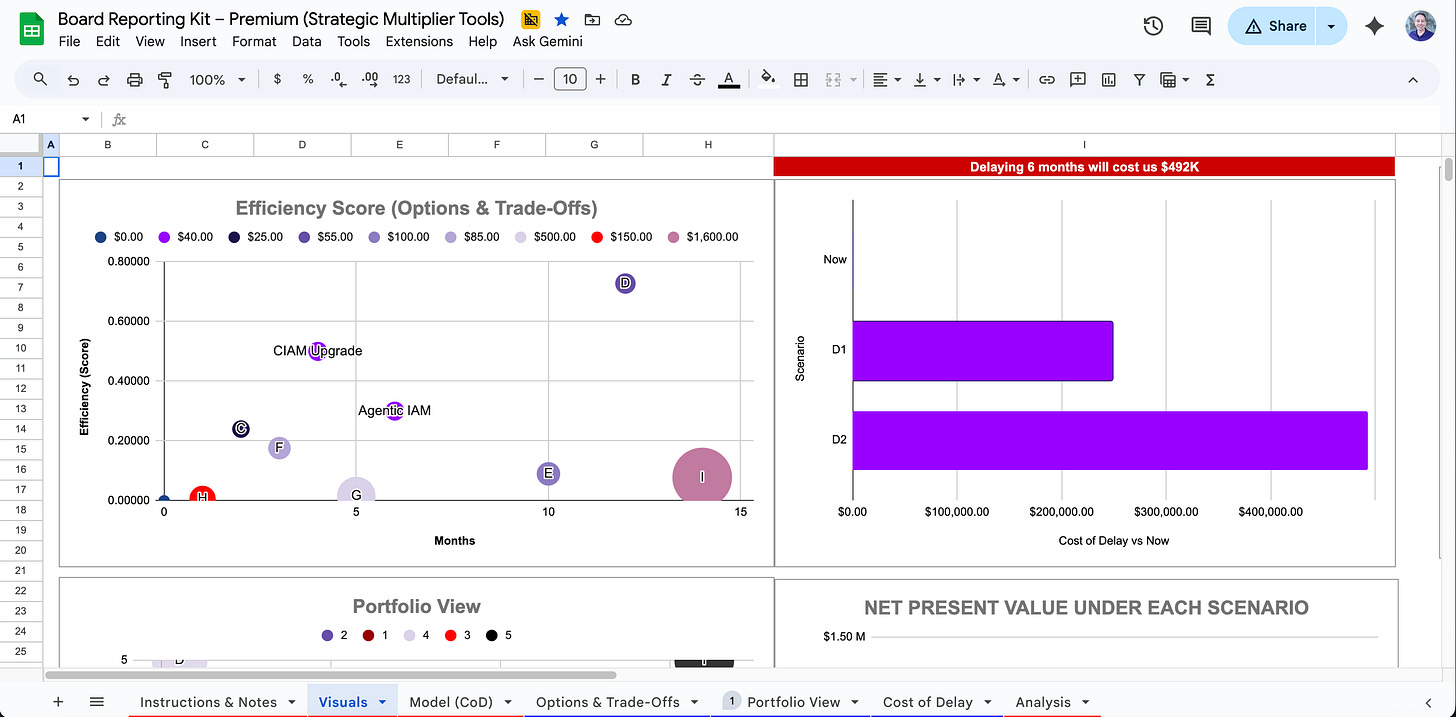

The Time Value of Money: ROI’s Silent Variable

Every executive understands the time value of money—a dollar today is worth more than a dollar next year.

But in cybersecurity and operations, this truth is often forgotten.

When projects stall in pursuit of pre-proven ROI, the organization quietly accrues what economists call the Cost of Delay.

Security risks persist. Operational inefficiencies linger. Opportunity costs compound.

Time is a variable in every ROI equation.

Real ROI, therefore, is a function of time, money, and resources—not just savings. It recognizes that the longer a system remains inefficient, the smaller the present value of future benefits becomes.

Waiting for proof before acting is, in financial terms, a negative-yield strategy.

Forecasting with Real Data

To transform ROI from abstraction into strategy, organizations must model it like they would any other investment—using financial data grounded in reality.

The process typically includes:

Establishing Baselines – Gather financial and operational metrics that describe the current state: time spent, headcount, system costs, and performance indicators.

Modeling Scenarios – Use those baselines to model potential future states under different investment scenarios.

Applying Discount Rates – Adjust for the time value of money to calculate the present value of future benefits.

Analyzing Sensitivity – Identify which variables most affect outcomes; this drives smarter decisions and better risk management.

This process isn’t theoretical—it’s how mature organizations make capital budgeting decisions every day.

ROI as a Strategic Instrument

Once leaders accept that ROI is forecastable, not provable, the question shifts from “What’s the number?” to “What’s the model?”

A credible ROI model is a strategic instrument for prioritization. It helps leaders allocate capital across competing priorities based on expected value creation, not gut feel.

For example:

An IAM modernization initiative might reduce operational cost and incident response time, improving both financial efficiency and enterprise resilience.

A workflow automation platform might reduce manual effort, reallocating skilled labor to higher-value work.

A governance dashboard might shorten reporting cycles, directly improving decision velocity and cost of coordination.

In each case, ROI isn’t proven in advance—it’s priced in advance and measured afterward.

That’s the discipline of real finance.

The Misunderstanding of “Proof”

Executives sometimes conflate forecasting with guaranteeing, but they’re fundamentally different.

Forecasting acknowledges uncertainty and quantifies it.

Guaranteeing denies it.

Demanding proof of ROI before engagement collapses the learning cycle that real innovation depends on.

The goal isn’t to eliminate uncertainty—it’s to make uncertainty investable.

That’s what separates a finance function from a procurement function.

Finance models potential return across a time horizon, adjusting for risk and delay.

Procurement demands certainty in a system that, by design, never offers it.

The strategic leader understands that you can’t measure ROI before you create the conditions for it to exist.

The Benefit of Shared Measurement

When both sides—provider and customer—commit to shared data, baselines, and transparency, ROI becomes not a point of contention but a system of continuous learning.

That’s why at Identient, our Strategic Performance Intelligence (SPI 360) framework builds ROI tracking into the engagement itself.

We don’t claim hypothetical returns. We create the environment to measure them—continuously, in real time.

This allows leadership teams to track Benefit-Cost Ratios dynamically, as projects mature and efficiency gains are realized. It replaces “proof” with visibility.

Beyond ROI: Real Options and Adaptive Value

Sophisticated financial modeling doesn’t stop at ROI or NPV—it extends into real options analysis, a method for valuing flexibility under uncertainty.

In cybersecurity, every investment creates future optionality—the ability to pivot faster, integrate more effectively, or scale without friction.

These are tangible financial benefits, even if they’re not reflected on a quarterly report.

Real options thinking transforms ROI from a static retrospective metric into a strategic forecast of adaptability.

It asks: “What is the value of keeping our options open?”

That’s a far more powerful question than, “What’s the ROI today?”

From Reporting to Strategy

When ROI is treated as proof, it becomes a rearview mirror.

When it’s treated as a forecast, it becomes a steering wheel.

Executives who understand this use ROI to inform where to steer next, not to justify where they’ve been.

This is where cybersecurity leaders can elevate their role—from cost managers to strategic investors in enterprise resilience.

By adopting cost-benefit analysis, time-value modeling, and real options frameworks, they move beyond budget defense into capital strategy.

Closing Thought

ROI isn’t something to prove; it’s something to build.

The discipline lies not in the pitch deck or the spreadsheet, but in the partnership that enables access to real data, shared baselines, and measurable outcomes over time.

In finance, as in cybersecurity, the most valuable returns compound quietly—through systems that learn, models that evolve, and leaders who understand that proving value starts by creating the conditions for it.

Closing Call to Action:

If you found this valuable and want to go deeper into how leaders make ROI real—balancing foresight, proof, and strategic execution—pick up my book, The CISO on the Razor’s Edge, available now on Amazon and Barnes & Noble.

If you’ve already purchased the book and want the companion Guide to Building a Business Case, just message me with a copy of your receipt—I’ll send you a private link to access it.